wa car sales tax calculator

Use our online sales tax calculator then speak with the auto finance experts at our VW dealer near Marysville WA. 30 Quarter 2 2021 April 1 - June 30.

Sales Tax Calculator Foothills Toyota

Additional information about the various components which make up the registration and title fees can be found at the links below.

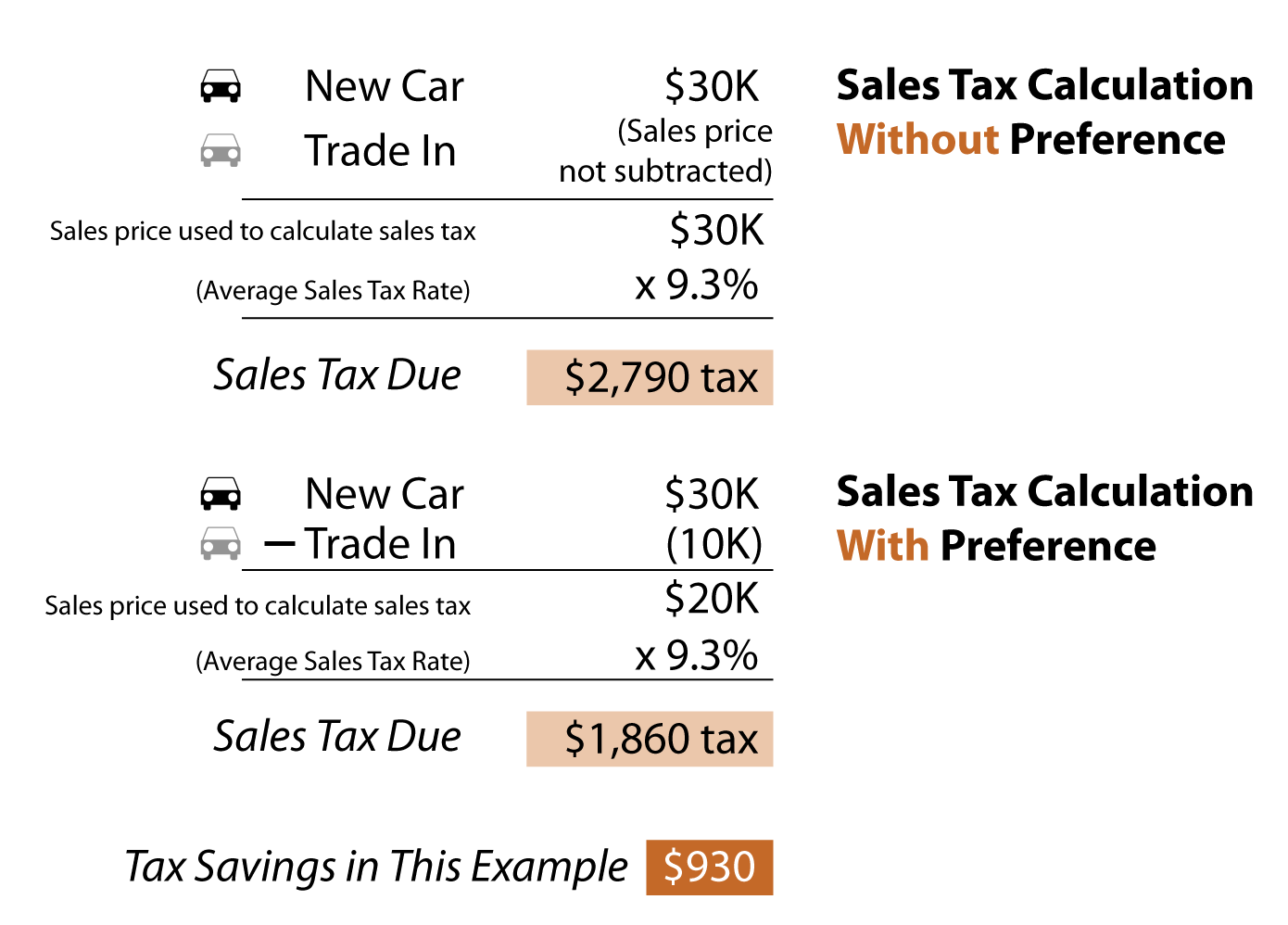

. Motor vehicle sales and use tax Motor vehicle dealers and motor vehicle leasing companies must collect the additional sales tax of three-tenths of one percent 3 of the selling price. Therefore car buyers get a tax break on trade-in vehicles in Washington. The state sales tax on a car purchase in Washington is 68.

Select classification of vehicle light or heavy vehicle and usednew. Tax and Tags Calculator. TAX DAY NOW MAY 17th - There are -445 days left.

So if youre looking for incredible savings youll find great deals on amazing cars and phenomenal tax savings when you buy your next vehicle here. Search by address zip plus four or use the map to find the rate for a specific location. When you purchase a vehicle or vessel from a private party youre required by law to pay use tax when the vehicle or vessel title is transferred.

Whether or not you have a trade-in. However this does not include any potential local or county taxes. Quarter 4 2021 Oct.

This would occur if a vehicle was purchased from a private party or if it was purchased. The DC DMV Vehicle Registration and Title Fee Estimator is provided to assist District residents in calculating the excise tax registration inspection tag title lien and residential parking fees. The state in which you live.

This number is a sum of the base state sales tax of 65 plus a 03 motor vehicle saleslease tax. The URL Interface provides a direct access to the Washington Department of Revenues address-based rate lookup technology platform. Our free online Washington sales tax calculator calculates exact sales tax by state county city or ZIP code.

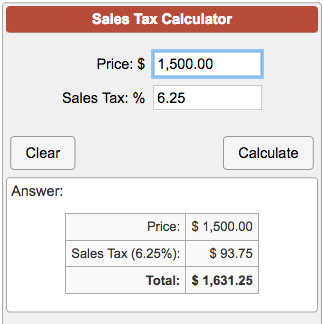

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Effective April 1 2022. GVM less than or equal to 45 tonnes.

Sum of Monthly Payments. To display the total vehicle licence duty payable for any vehicle. Use tax is calculated at the same rate as the sales tax at the purchasers.

In the case where a vehicle is purchased more than 2000 below the fair market value of the vehicle determined by pricing guides like Kelley Blue Book the state will assess the tax you owe on the average fair market value. Local sales use tax rates for motor vehicles sales or leases. Youll find rates for sales and use tax motor vehicle taxes and lodging tax.

The county the vehicle is registered in. 31 Quarter 3 2021 July 1 - Sept. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

Start filing your tax return now. If youre looking for incredible savings youll find great deals on amazing cars and phenomenal tax savings when you buy your next vehicle here. Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington.

The tax is collected by the vendor at the time of purchase and submitted by the vendor on the excise tax return. Click on the Calculate Fee Payable button. The type of license plates requested.

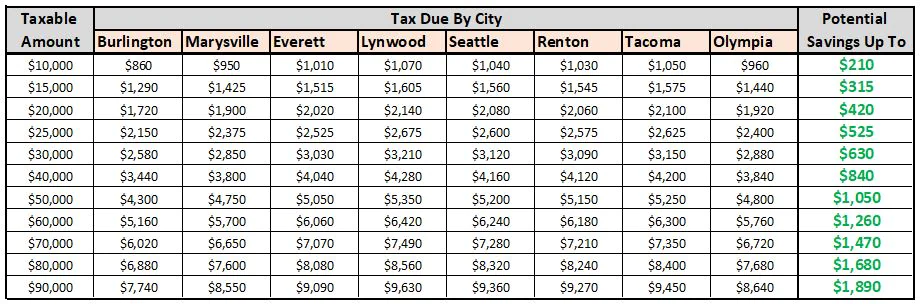

The tax amount is based upon the value of the vehicle at the time of purchase and is the same retail sales tax of 65. Vehicle taxes rates in other cities up to. Before-tax price sale tax rate and final or after-tax price.

Enter the Dutiable value of the vehicle in the field below. How are car loans in Washington calculated. Washington includes the sale price and the doc fee in the taxable amount of an auto loan but does not include the trade-in value.

Franklin County Mental Health Tax Car Dealers and Leasing Companies. Kittitas County Housing and Related Services Car Dealers and Leasing Companies. Use tax rates.

Use tax is a tax on items used in Washington when sales tax hasnt been paid. Look up a tax rate. Sales and use tax within all of Whatcom County will increase one-tenth of one percent 001.

The average local tax rate in Washington is 2368 which brings the total average rate to 8868. Our tax rate is 86 well below some of our neighbors. Using the URL interface we provide you can access sales and use tax rate data using address or ZIP 4 code information and tie the data into your shopping cart checkout process or accounting system in real time.

During the year to deduct sales tax instead of income tax if their total sales tax payments exceed state. Motor vehicle sales or leases change notices. New car sales tax OR used car sales tax.

The tax will be used for housing and related services. With an 86 Sales Tax here in Burlington WA and start saving. If sales tax was not paid at the time of purchase use tax applies at the time the vehicle is registered with the Department of Licensing.

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Woocommerce Sales Tax In The Us How To Automate Calculations

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Car Sales Tax Savings Car Incentives In Burlington Wafacebook

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Pennsylvania Sales Tax Small Business Guide Truic

State Corporate Income Tax Rates And Brackets Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Clearance 53 Off Www Ingeniovirtual Com

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Trade In Sales Tax Savings Calculator Find The Best Car Price